Archives

- By thread 1419

-

By date

- August 2019 59

- September 2019 118

- October 2019 165

- November 2019 97

- December 2019 35

- January 2020 58

- February 2020 204

- March 2020 121

- April 2020 172

- May 2020 50

- June 2020 158

- July 2020 85

- August 2020 94

- September 2020 193

- October 2020 277

- November 2020 100

- December 2020 159

- January 2021 38

- February 2021 87

- March 2021 146

- April 2021 73

- May 2021 90

- June 2021 86

- July 2021 123

- August 2021 50

- September 2021 68

- October 2021 66

- November 2021 74

- December 2021 75

- January 2022 98

- February 2022 77

- March 2022 68

- April 2022 31

- May 2022 59

- June 2022 87

- July 2022 141

- August 2022 38

- September 2022 73

- October 2022 152

- November 2022 39

- December 2022 50

- January 2023 93

- February 2023 49

- March 2023 106

- April 2023 47

- May 2023 69

- June 2023 92

- July 2023 64

- August 2023 103

- September 2023 91

- October 2023 101

- November 2023 94

- December 2023 46

- January 2024 75

- February 2024 79

- March 2024 104

- April 2024 63

- May 2024 40

- June 2024 160

- July 2024 80

- August 2024 70

- September 2024 62

- October 2024 121

- November 2024 117

- December 2024 89

- January 2025 59

- February 2025 104

- March 2025 96

- April 2025 107

- May 2025 52

- June 2025 72

- July 2025 60

- August 2025 81

- September 2025 124

- October 2025 63

- November 2025 22

Contributors

-

Re: QWeb widget templates - unable to use extension inheritance mode?

I am no expert as well so I may be missing something crucial. What you describe is deprecated mechanism that doesn't allow in-place extension of the template. I mean you cannot change existing template without assigning it a new name (at least as far as I know). For both there is nice documentation online: https://www.odoo.com/documentation/13.0/reference/qweb.html#template-inheritance

Initially I tried to use that mechanism you mention as well. But there is this (marked in red) in main template:

<div t-name="website.contentMenu.dialog.edit">

<select class="form-control mb16" t-if="widget.roots">

<t t-foreach="widget.roots" t-as="root">

<option t-att-value="root.id"><t t-esc="root.name"/></option>

</t>

</select>

<ul class="oe_menu_editor list-unstyled">

<t t-foreach="widget.menu.children" t-as="submenu">

<t t-call="website.contentMenu.dialog.submenu"/>

</t>

</ul>

<div class="mt32">

<small class="float-right text-muted">

Drag to the right to get a submenu

</small>

<a href="#" class="js_add_menu">

<i class="fa fa-plus-circle"/> Add Menu Item

</a><br/>

<a href="#" class="js_add_menu" data-type="mega">

<i class="fa fa-plus-circle"/> Add Mega Menu Item

</a>

</div>

</div>

That is call to sub-template that has no associated JS object. So if I extended that template it would have different name so I would need to modify this template to reflect that. Tried and failed. Didn't work.

Best regards

Radovan

On štvrtok 6. augusta 2020 12:46:56 CEST Graeme Gellatly wrote:

> I never did it that way. I'm no expert but usually I use t-jquery

> t-operation t-extend style syntax. On Thu, 6 Aug 2020, 9:26 pm Radovan

> Skolnik, < radovan@skolnik.info [1] > wrote: Hello,

>

> I am working on a module that would allow to assgin icons to website menus

> to be rendered in custom theme. This is what I achieved:

>

>

> Everything works as expected but I stumbled to template inheritance issue on

> the first widget - that is template: 'website.contentMenu.dialog.edit'

> defined in /addons/website/static/src/xml/website.contentMenu.xml For

> individual menu items it uses recursively template

> 'website.contentMenu.dialog.submenu' that has no JavaScript object

> associated. Now I wanted to use extension inheritance to alter content of

> this sub-template to render image/icon. So my aim was to use something like

> this:

>

> <t t-inherit="website.contentMenu.dialog.submenu"

> t-inherit-mode="extension"> <xpath

> expr="//span[hasclass('input-group-append')]" position="inside"> <button

> type="button" t-att-class="submenu.fields['image']" aria-label="Menu Image"

> title="Menu Image"/> </xpath>

> </t>

>

> Now whetever I tried this didn't work for me. I also tried to use something

> similar on the main template which is used by my JavaScript object extended

> from original. Didn't work as well. If it took my template it would

> generate into HTML literally the content of outer <t> tag - so the HTML

> contained tags <xpath expr="..."> and so on.

>

> I solved it temporarily but copying both templates into my own file and

> modified them. But I would love to make this more elegant and extend the

> templates in-place as stated in documentation. Has anyone some experience

> with this? In all of the source code of Odoo 13.0, 12.0 and 11.0 I didn't

> find a single use of this feature for a reference.

>

> Thank you for any help. Best regards

>

> Radovan Skolnik

> _______________________________________________

> Mailing-List: https://odoo-community.org/groups/contributors-15 [2]

> Post to: mailto: contributors@odoo-community.org [3]

> Unsubscribe: https://odoo-community.org/groups?unsubscribe [4]

>

>

> _______________________________________________

> Mailing-List: https://odoo-community.org/groups/contributors-15 [5]

> Post to: mailto:contributors@odoo-community.org

> Unsubscribe: https://odoo-community.org/groups?unsubscribe [6]

>

>

>

> [1] mailto:radovan@skolnik.info

> [2] https://odoo-community.org/groups/contributors-15

> [3] mailto:contributors@odoo-community.org

> [4] https://odoo-community.org/groups?unsubscribe

> [5] https://odoo-community.org/groups/contributors-15

> [6] https://odoo-community.org/groups?unsubscribe

by Radovan Skolnik - 01:31 - 6 Aug 2020 -

Re: QWeb widget templates - unable to use extension inheritance mode?

I never did it that way. I'm no expert but usually I use t-jquery t-operation t-extend style syntax.On Thu, 6 Aug 2020, 9:26 pm Radovan Skolnik, <radovan@skolnik.info> wrote:Hello,

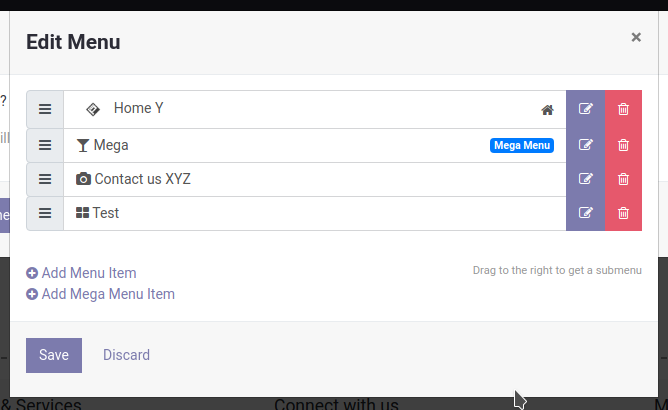

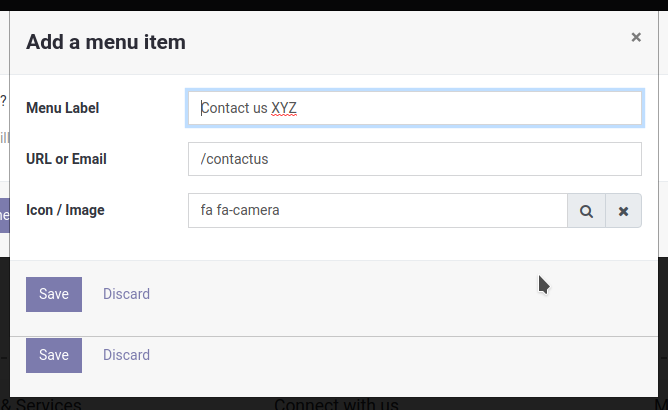

I am working on a module that would allow to assgin icons to website menus to be rendered in custom theme. This is what I achieved:

Everything works as expected but I stumbled to template inheritance issue on the first widget - that is template: 'website.contentMenu.dialog.edit' defined in /addons/website/static/src/xml/website.contentMenu.xml For individual menu items it uses recursively template 'website.contentMenu.dialog.submenu' that has no JavaScript object associated. Now I wanted to use extension inheritance to alter content of this sub-template to render image/icon. So my aim was to use something like this:

<t t-inherit="website.contentMenu.dialog.submenu" t-inherit-mode="extension">

<xpath expr="//span[hasclass('input-group-append')]" position="inside">

<button type="button" t-att-class="submenu.fields['image']" aria-label="Menu Image" title="Menu Image"/>

</xpath>

</t>

Now whetever I tried this didn't work for me. I also tried to use something similar on the main template which is used by my JavaScript object extended from original. Didn't work as well. If it took my template it would generate into HTML literally the content of outer <t> tag - so the HTML contained tags <xpath expr="..."> and so on.

I solved it temporarily but copying both templates into my own file and modified them. But I would love to make this more elegant and extend the templates in-place as stated in documentation. Has anyone some experience with this? In all of the source code of Odoo 13.0, 12.0 and 11.0 I didn't find a single use of this feature for a reference.

Thank you for any help. Best regards

Radovan Skolnik

_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe

by Graeme Gellatly - 12:45 - 6 Aug 2020 -

QWeb widget templates - unable to use extension inheritance mode?

Hello,

I am working on a module that would allow to assgin icons to website menus to be rendered in custom theme. This is what I achieved:

Everything works as expected but I stumbled to template inheritance issue on the first widget - that is template: 'website.contentMenu.dialog.edit' defined in /addons/website/static/src/xml/website.contentMenu.xml For individual menu items it uses recursively template 'website.contentMenu.dialog.submenu' that has no JavaScript object associated. Now I wanted to use extension inheritance to alter content of this sub-template to render image/icon. So my aim was to use something like this:

<t t-inherit="website.contentMenu.dialog.submenu" t-inherit-mode="extension">

<xpath expr="//span[hasclass('input-group-append')]" position="inside">

<button type="button" t-att-class="submenu.fields['image']" aria-label="Menu Image" title="Menu Image"/>

</xpath>

</t>

Now whetever I tried this didn't work for me. I also tried to use something similar on the main template which is used by my JavaScript object extended from original. Didn't work as well. If it took my template it would generate into HTML literally the content of outer <t> tag - so the HTML contained tags <xpath expr="..."> and so on.

I solved it temporarily but copying both templates into my own file and modified them. But I would love to make this more elegant and extend the templates in-place as stated in documentation. Has anyone some experience with this? In all of the source code of Odoo 13.0, 12.0 and 11.0 I didn't find a single use of this feature for a reference.

Thank you for any help. Best regards

Radovan Skolnik

by Radovan Skolnik - 11:26 - 6 Aug 2020 -

Re: OCA module for inventory coverage?

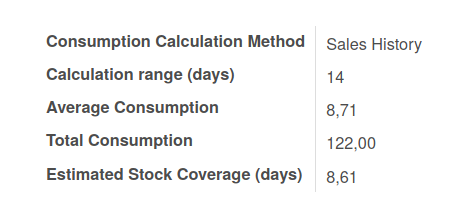

Hello Alex,We did something for our customers (Food Coops in Belgium and Switzerland) to help decide what should be re-purchased:It does not provide a report, but a simple tree view:And on each product you can decide the number of days on which you want to do the calculation:

It can be used with this module (that creates an intermediary purchase order to try different quantities to be purchased and see the stock coverage based on the quantity):We would be happy to propose them to OCA if they are considered useful!Have a nice day,--

Virginie0477/64.17.20--Si vous avez un contrat de support, posez-nous vos question à l'adresse "support@coopiteasy.be"--Lors de l'envoi d'un mail, renseignez le nom de la structure pour laquelle vous travaillez. Merci.-------- Message initial --------De: "Roussel, Denis" <denis.roussel@acsone.eu>Répondre à: Odoo Community Association (OCA) Contributors <contributors@odoo-community.org>À: Contributors <contributors@odoo-community.org>Objet: Re: OCA module for inventory coverage?Date: Mon, 03 Aug 2020 08:32:08 -0000Hi Alex,Maybe you can look into https://github.com/OCA/stock-logistics-reporting/ if you find a module that makes you happy.That one https://github.com/OCA/stock-logistics-reporting/tree/12.0/stock_inventory_turnover_report could but a little bit specific.Have a nice dayOn Mon, Aug 3, 2020 at 10:02 AM Alexandre Fayolle <alexandre.fayolle@camptocamp.com> wrote:Hello everyone,

Do we have a module for inventory coverage in the OCA?

I need to produce a report giving how long the current stock for a given

product will last given the average sale rate of the last X days.

I've seen a couple modules of Odoo App store for this, but I'd prefer

having an OCA solution.

--

Alexandre Fayolle

Chef de Projet

Tel : +33 4 58 48 20 30

Camptocamp France SAS

18 rue du Lac Saint André

73 370 Le Bourget-du-Lac

France

http://www.camptocamp.com

_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe

by Virginie Dewulf. - 11:20 - 3 Aug 2020 -

Re: OCA module for inventory coverage?

Hi Alex,Maybe you can look into https://github.com/OCA/stock-logistics-reporting/ if you find a module that makes you happy.That one https://github.com/OCA/stock-logistics-reporting/tree/12.0/stock_inventory_turnover_report could but a little bit specific.Have a nice dayOn Mon, Aug 3, 2020 at 10:02 AM Alexandre Fayolle <alexandre.fayolle@camptocamp.com> wrote:Hello everyone, Do we have a module for inventory coverage in the OCA? I need to produce a report giving how long the current stock for a given product will last given the average sale rate of the last X days. I've seen a couple modules of Odoo App store for this, but I'd prefer having an OCA solution. -- Alexandre Fayolle Chef de Projet Tel : +33 4 58 48 20 30 Camptocamp France SAS 18 rue du Lac Saint André 73 370 Le Bourget-du-Lac France http://www.camptocamp.com_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe

--__________________________________________

Denis Roussel

Software Engineer

Acsone SA, Succursale de Liège (Val Benoît)

Tel : +32 2 888 31 49

Fax : +32 2 888 31 59

Gsm : +32 472 22 00 57Acsone sa/nv

Boulevard de la Woluwe 56 Woluwedal | B-1200 Brussels | BelgiumQuai Banning, 6 (Val Benoît) | B-4000 Liège | Belgium

Zone Industrielle 22 | L-8287 Kehlen | Luxembourg

by Denis Roussel - 10:31 - 3 Aug 2020 -

OCA module for inventory coverage?

Hello everyone, Do we have a module for inventory coverage in the OCA? I need to produce a report giving how long the current stock for a given product will last given the average sale rate of the last X days. I've seen a couple modules of Odoo App store for this, but I'd prefer having an OCA solution. -- Alexandre Fayolle Chef de Projet Tel : +33 4 58 48 20 30 Camptocamp France SAS 18 rue du Lac Saint André 73 370 Le Bourget-du-Lac France http://www.camptocamp.com

by Alexandre Fayolle - 10:00 - 3 Aug 2020 -

RE: Financial budgeting in V14

Does anyone know what Odoo are doing to enhance financial budgeting in V14. I know some spreadsheet like features are being added to the pivot table view but how exactly this will translate to the budgeting requirement I am not sure. I have not been able to find anything on RunBot.Kind regardsJonathan Wilson

Chief Sales and Innovation Executive

WilldooIT Pty Ltd

Recent Linkedin articles:First Australian Odoo GOLD partner2017, 2015 & 2013 Odoo Best Partner Asia/PacificCreators of Odoo-Pentaho integration project"Making growth through technology easy"

E: jonathan.wilson@willdooit.com

P: +61 3 9135 1900

M: +61 4 000 17 444

10/435 Williamstown Road

Port Melbourne VIC 3207

DISCLAIMER | This electronic message together with any attachments is confidential. If you are not the recipient, do not copy, disclose, or use the contents in any way. Please also advise us by e-mail that you have received this message in error and then please destroy this email and any of its attachments. WilldooIT Pty. Ltd. is not responsible for any changes made to this message and/or any attachments after sending by Willdoo IT Pty. Ltd. WilldooIT Pty. Ltd. use virus scanning software but exclude all liability for virus or anything similar in this email or attachment.

by Jonathan Wilson - 03:25 - 2 Aug 2020 -

Re: Issue with OCA module : auth_session_timeout

Please can anyone help here. Thanks a lot''Where others see limitations, we see possibilities''Othmane Ghandi----------------------------------------------------------------------------------------------------------------------------------------------"les bonnes choses viennent à ceux qui savent attendre. Les grandes choses viennent à ceux qui se lèvent et qui font tout pour y arriver"-----------------------------------------------------------------------------------------------------------------------------------------------: othmane.ghandi

: +49 17 632214006

: +212 6 00 45 96 84

Le jeu. 23 juil. 2020 à 15:51, GHANDI Othmane <othmane.ghandi@gmail.com> a écrit :Hi CommunityWhen installing the module auth_session_timeout for inactivity timeout, the popup/wizard od Odoo session expired appears many time (You need to click many times so that it goes, as showing in this GIF)If anyone faced the same issue or succeeded to solve it, please reveal yourself 😁 no one will hurt you.Big thanks''Where others see limitations, we see possibilities''Othmane Ghandi----------------------------------------------------------------------------------------------------------------------------------------------"les bonnes choses viennent à ceux qui savent attendre. Les grandes choses viennent à ceux qui se lèvent et qui font tout pour y arriver"-----------------------------------------------------------------------------------------------------------------------------------------------: othmane.ghandi

: +49 17 632214006

: +212 6 00 45 96 84

by Othmane Ghandi - 10:35 - 31 Jul 2020 -

RE: Operation related to Asset Management

Kitti,

Basic features that about every company managing financial assets in odoo should imho be in the base module.

Extra features that impact only certain companies (e.g. separate calculation for taxes) are better in a separate module.

Luc

From: Kitti Upariphutthiphong <kittiu@ecosoft.co.th>

Sent: Thursday, 30 July 2020 04:07

To: Contributors <contributors@odoo-community.org>

Subject: Re: Operation related to Asset ManagementKevin,

Thank you very much! Please tag us, so we can help review it.

So, I think yours module will be on value adjustment (plus other), right? may be I should start with asset under construction (split / merge).

I am just curious why you think most features should be in account_asset_manageent. While, I think it will be good to be separated, and it is the nature of Odoo and OCA. WDYT?

Kitti

On Thu, Jul 30, 2020 at 4:26 AM Kevin McMenamin <Kevin.McMenamin@solnet.co.nz> wrote:

Kitti

I am migrating our module to V13 – quite a few changes as Odoo have totally changed the way depreciation works. I’ll send through once completed

From: Kitti Upariphutthiphong <kittiu@ecosoft.co.th>

Sent: Saturday, 25 July 2020 4:17 PM

To: Contributors <contributors@odoo-community.org>

Subject: Re: Operation related to Asset ManagementThank you all,

@Jonathan, I am not quite familiar with the Book and Tax. I have asked our functional consult, and we think it is also a case in our country, although it is not very common (still not sure it is the same thing as yours). Do you have more detail on what it is, somewhere I can read?

@Luc, from what I understand here, we need the same, but the naming may be a bit different (we also need the right business name). So, here is the refined list of TODO from me, please help redefine it, or suggest better terms if you are certain.

Should I call this set of feature, Asset Operations? Which I think it should be separated, WDYT?

- Asset Revaluation -- account_asset_management_oper_revalue

- Not only impairment but value increment, so I think this name is ok?

· Asset Merge - account_asset_management_oper_merge

- At first I used transfer for both merge and split

- Mainly used for case assets under construction that one or multiple assets will become a new asset.

· Asset Split - account_asset_management_oper_split

- When bought in a big asset, that can be decomposed it to several active asset and start depreciation.

Also notable feature mentioned by Kevin, I think should be the enhancement to the account_asset_management

· Proper handling of gain/loss on disposal

· Depreciation start date separate from asset date

@Kevin, your sharing would be great.

As for the Book and Tax, I also think it should be seperated feature. I also don't know much about it yet.

Thank you for feedback,

Kitti

On Thu, Jul 23, 2020 at 1:37 PM <luc.demeyer@noviat.com> wrote:

I think we should make two documents

- Asset impairment (a feature to be added to the base module)

- Tax depreciation (imho a separate add-on module)

The other two are small features already available in some form in the current module.

Luc

From: Jonathan Wilson <jonathan.wilson@willdooit.com>

Sent: Wednesday, 22 July 2020 23:02

To: Contributors <contributors@odoo-community.org>

Subject: Re: Operation related to Asset ManagementIf we could get a requirements & design document for the new features, including book & tax methods, I pretty sure I could get funding from a customer.

Kind regards

Jonathan Wilson

Chief Sales and Innovation Executive

WilldooIT Pty Ltd

Recent Linkedin articles:

First Australian Odoo GOLD partner

2017, 2015 & 2013 Odoo Best Partner Asia/Pacific

Creators of Odoo-Pentaho integration project

"Making growth through technology easy"

E: jonathan.wilson@willdooit.com

P: +61 3 9135 1900

M: +61 4 000 17 444

10/435 Williamstown Road

Port Melbourne VIC 3207

DISCLAIMER | This electronic message together with any attachments is confidential. If you are not the recipient, do not copy, disclose, or use the contents in any way. Please also advise us by e-mail that you have received this message in error and then please destroy this email and any of its attachments. WilldooIT Pty. Ltd. is not responsible for any changes made to this message and/or any attachments after sending by Willdoo IT Pty. Ltd. WilldooIT Pty. Ltd. use virus scanning software but exclude all liability for virus or anything similar in this email or attachment.

On Thu, 23 Jul 2020 at 05:32, Kevin McMenamin <Kevin.McMenamin@solnet.co.nz> wrote:

We have done quite a bit around assets and happy to share (currently still on V11)

- Proper handling of gain/loss on disposal

- Asset impairment

- Depreciation start date separate from asset date

- Accounting & Tax depreciation rates (we handle tax via reporting as typically done annually)

Plus have tidied up various accounting elements to ensure works correctly.

Happy to share.

Regards

Kevin McMenamin

ERP Capability Manager, Solnet

+64 22 651 3753 | +64 9 977 5805 | Visit our blog | Connect on LinkedIn

From: luc.demeyer@noviat.com <luc.demeyer@noviat.com>

Sent: Wednesday, 22 July 2020 7:27 PM

To: Contributors <contributors@odoo-community.org>

Subject: RE: Operation related to Asset ManagementI am not sure if we need to add the book & tax feature into the base module.

I think it’s more a feature for an add-on module.

Luc

From: Jonathan Wilson <jonathan.wilson@willdooit.com>

Sent: Wednesday, 22 July 2020 08:33

To: Contributors <contributors@odoo-community.org>

Subject: Re: Operation related to Asset ManagementHi Kitti

My experience with decent Asset apps is that they have that functionality. Additionally, they usually have 2 modes of depreciation - "Book" and "Tax" - if we could add those features (and the ones you mentioned) I would fee a lot more comfortable offering up Odoo as a decent asset register.

Kind regards

Jonathan Wilson

Chief Sales and Innovation Executive

WilldooIT Pty Ltd

Recent Linkedin articles:

First Australian Odoo GOLD partner

2017, 2015 & 2013 Odoo Best Partner Asia/Pacific

Creators of Odoo-Pentaho integration project

"Making growth through technology easy"

E: jonathan.wilson@willdooit.com

P: +61 3 9135 1900

M: +61 4 000 17 444

10/435 Williamstown Road

Port Melbourne VIC 3207

DISCLAIMER | This electronic message together with any attachments is confidential. If you are not the recipient, do not copy, disclose, or use the contents in any way. Please also advise us by e-mail that you have received this message in error and then please destroy this email and any of its attachments. WilldooIT Pty. Ltd. is not responsible for any changes made to this message and/or any attachments after sending by Willdoo IT Pty. Ltd. WilldooIT Pty. Ltd. use virus scanning software but exclude all liability for virus or anything similar in this email or attachment.

On Wed, 22 Jul 2020 at 16:17, Kitti Upariphutthiphong <kittiu@ecosoft.co.th> wrote:

Dear community,

My I check whether the following feature is relevant to OCA or being useful.

We done Odoo and got to learn some practice from an organization that deal with a lot of asset. Both normal asset, low valued asset, asset in transit, asset under construction.

They have asset operation like,

- Change Ownership,

- i.e, change cost center (analytic)

- Value Adjustment,

- i.e., knowing sometime later that, there are additional expenditure into that assets and so the value should be increased

- Transfer (merge or split),

- i.e., 2 asset under construction, merged as new final working Asset.

- An normal acquired asset that splits into smaller assets.

We would love to port these features into OCA. But I am not very sure it will be useful, nor is it generic enough.

Any comments?

Kitti

_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribeAttention: This email may contain information intended for the sole use of the original recipient. Please respect this when sharing or disclosing this email's contents with any third party. If you believe you have received this email in error, please delete it and notify the sender or postmaster@solnetsolutions.co.nz as soon as possible. The content of this email does not necessarily reflect the views of Solnet Solutions Ltd.

_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribeAttention: This email may contain information intended for the sole use of the original recipient. Please respect this when sharing or disclosing this email's contents with any third party. If you believe you have received this email in error, please delete it and notify the sender or postmaster@solnetsolutions.co.nz as soon as possible. The content of this email does not necessarily reflect the views of Solnet Solutions Ltd.

_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe

by Luc De Meyer. - 08:31 - 30 Jul 2020 -

Re: Operation related to Asset Management

Kevin,Thank you very much! Please tag us, so we can help review it.So, I think yours module will be on value adjustment (plus other), right? may be I should start with asset under construction (split / merge).I am just curious why you think most features should be in account_asset_manageent. While, I think it will be good to be separated, and it is the nature of Odoo and OCA. WDYT?KittiOn Thu, Jul 30, 2020 at 4:26 AM Kevin McMenamin <Kevin.McMenamin@solnet.co.nz> wrote:Attention: This email may contain information intended for the sole use of the original recipient. Please respect this when sharing or disclosing this email's contents with any third party. If you believe you have received this email in error, please delete it and notify the sender or postmaster@solnetsolutions.co.nz as soon as possible. The content of this email does not necessarily reflect the views of Solnet Solutions Ltd.Kitti

I am migrating our module to V13 – quite a few changes as Odoo have totally changed the way depreciation works. I’ll send through once completed

From: Kitti Upariphutthiphong <kittiu@ecosoft.co.th>

Sent: Saturday, 25 July 2020 4:17 PM

To: Contributors <contributors@odoo-community.org>

Subject: Re: Operation related to Asset ManagementThank you all,

@Jonathan, I am not quite familiar with the Book and Tax. I have asked our functional consult, and we think it is also a case in our country, although it is not very common (still not sure it is the same thing as yours). Do you have more detail on what it is, somewhere I can read?

@Luc, from what I understand here, we need the same, but the naming may be a bit different (we also need the right business name). So, here is the refined list of TODO from me, please help redefine it, or suggest better terms if you are certain.

Should I call this set of feature, Asset Operations? Which I think it should be separated, WDYT?

- Asset Revaluation -- account_asset_management_oper_revalue

- Not only impairment but value increment, so I think this name is ok?

· Asset Merge - account_asset_management_oper_merge

- At first I used transfer for both merge and split

- Mainly used for case assets under construction that one or multiple assets will become a new asset.

· Asset Split - account_asset_management_oper_split

- When bought in a big asset, that can be decomposed it to several active asset and start depreciation.

Also notable feature mentioned by Kevin, I think should be the enhancement to the account_asset_management

· Proper handling of gain/loss on disposal

· Depreciation start date separate from asset date

@Kevin, your sharing would be great.

As for the Book and Tax, I also think it should be seperated feature. I also don't know much about it yet.

Thank you for feedback,

Kitti

On Thu, Jul 23, 2020 at 1:37 PM <luc.demeyer@noviat.com> wrote:

I think we should make two documents

- Asset impairment (a feature to be added to the base module)

- Tax depreciation (imho a separate add-on module)

The other two are small features already available in some form in the current module.

Luc

From: Jonathan Wilson <jonathan.wilson@willdooit.com>

Sent: Wednesday, 22 July 2020 23:02

To: Contributors <contributors@odoo-community.org>

Subject: Re: Operation related to Asset ManagementIf we could get a requirements & design document for the new features, including book & tax methods, I pretty sure I could get funding from a customer.

Kind regards

Jonathan Wilson

Chief Sales and Innovation Executive

WilldooIT Pty Ltd

Recent Linkedin articles:

First Australian Odoo GOLD partner

2017, 2015 & 2013 Odoo Best Partner Asia/Pacific

Creators of Odoo-Pentaho integration project

"Making growth through technology easy"

E: jonathan.wilson@willdooit.com

P: +61 3 9135 1900

M: +61 4 000 17 444

10/435 Williamstown Road

Port Melbourne VIC 3207

DISCLAIMER | This electronic message together with any attachments is confidential. If you are not the recipient, do not copy, disclose, or use the contents in any way. Please also advise us by e-mail that you have received this message in error and then please destroy this email and any of its attachments. WilldooIT Pty. Ltd. is not responsible for any changes made to this message and/or any attachments after sending by Willdoo IT Pty. Ltd. WilldooIT Pty. Ltd. use virus scanning software but exclude all liability for virus or anything similar in this email or attachment.

On Thu, 23 Jul 2020 at 05:32, Kevin McMenamin <Kevin.McMenamin@solnet.co.nz> wrote:

We have done quite a bit around assets and happy to share (currently still on V11)

- Proper handling of gain/loss on disposal

- Asset impairment

- Depreciation start date separate from asset date

- Accounting & Tax depreciation rates (we handle tax via reporting as typically done annually)

Plus have tidied up various accounting elements to ensure works correctly.

Happy to share.

Regards

Kevin McMenamin

ERP Capability Manager, Solnet

+64 22 651 3753 | +64 9 977 5805 | Visit our blog | Connect on LinkedIn

From: luc.demeyer@noviat.com <luc.demeyer@noviat.com>

Sent: Wednesday, 22 July 2020 7:27 PM

To: Contributors <contributors@odoo-community.org>

Subject: RE: Operation related to Asset ManagementI am not sure if we need to add the book & tax feature into the base module.

I think it’s more a feature for an add-on module.

Luc

From: Jonathan Wilson <jonathan.wilson@willdooit.com>

Sent: Wednesday, 22 July 2020 08:33

To: Contributors <contributors@odoo-community.org>

Subject: Re: Operation related to Asset ManagementHi Kitti

My experience with decent Asset apps is that they have that functionality. Additionally, they usually have 2 modes of depreciation - "Book" and "Tax" - if we could add those features (and the ones you mentioned) I would fee a lot more comfortable offering up Odoo as a decent asset register.

Kind regards

Jonathan Wilson

Chief Sales and Innovation Executive

WilldooIT Pty Ltd

Recent Linkedin articles:

First Australian Odoo GOLD partner

2017, 2015 & 2013 Odoo Best Partner Asia/Pacific

Creators of Odoo-Pentaho integration project

"Making growth through technology easy"

E: jonathan.wilson@willdooit.com

P: +61 3 9135 1900

M: +61 4 000 17 444

10/435 Williamstown Road

Port Melbourne VIC 3207

DISCLAIMER | This electronic message together with any attachments is confidential. If you are not the recipient, do not copy, disclose, or use the contents in any way. Please also advise us by e-mail that you have received this message in error and then please destroy this email and any of its attachments. WilldooIT Pty. Ltd. is not responsible for any changes made to this message and/or any attachments after sending by Willdoo IT Pty. Ltd. WilldooIT Pty. Ltd. use virus scanning software but exclude all liability for virus or anything similar in this email or attachment.

On Wed, 22 Jul 2020 at 16:17, Kitti Upariphutthiphong <kittiu@ecosoft.co.th> wrote:

Dear community,

My I check whether the following feature is relevant to OCA or being useful.

We done Odoo and got to learn some practice from an organization that deal with a lot of asset. Both normal asset, low valued asset, asset in transit, asset under construction.

They have asset operation like,

- Change Ownership,

- i.e, change cost center (analytic)

- Value Adjustment,

- i.e., knowing sometime later that, there are additional expenditure into that assets and so the value should be increased

- Transfer (merge or split),

- i.e., 2 asset under construction, merged as new final working Asset.

- An normal acquired asset that splits into smaller assets.

We would love to port these features into OCA. But I am not very sure it will be useful, nor is it generic enough.

Any comments?

Kitti

_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribeAttention: This email may contain information intended for the sole use of the original recipient. Please respect this when sharing or disclosing this email's contents with any third party. If you believe you have received this email in error, please delete it and notify the sender or postmaster@solnetsolutions.co.nz as soon as possible. The content of this email does not necessarily reflect the views of Solnet Solutions Ltd.

_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe

by Kitti Upariphutthiphong - 04:06 - 30 Jul 2020 -

RE: Operation related to Asset Management

Attention: This email may contain information intended for the sole use of the original recipient. Please respect this when sharing or disclosing this email's contents with any third party. If you believe you have received this email in error, please delete it and notify the sender or postmaster@solnetsolutions.co.nz as soon as possible. The content of this email does not necessarily reflect the views of Solnet Solutions Ltd.Kitti

I am migrating our module to V13 – quite a few changes as Odoo have totally changed the way depreciation works. I’ll send through once completed

From: Kitti Upariphutthiphong <kittiu@ecosoft.co.th>

Sent: Saturday, 25 July 2020 4:17 PM

To: Contributors <contributors@odoo-community.org>

Subject: Re: Operation related to Asset ManagementThank you all,

@Jonathan, I am not quite familiar with the Book and Tax. I have asked our functional consult, and we think it is also a case in our country, although it is not very common (still not sure it is the same thing as yours). Do you have more detail on what it is, somewhere I can read?

@Luc, from what I understand here, we need the same, but the naming may be a bit different (we also need the right business name). So, here is the refined list of TODO from me, please help redefine it, or suggest better terms if you are certain.

Should I call this set of feature, Asset Operations? Which I think it should be separated, WDYT?

- Asset Revaluation -- account_asset_management_oper_revalue

- Not only impairment but value increment, so I think this name is ok?

· Asset Merge - account_asset_management_oper_merge

- At first I used transfer for both merge and split

- Mainly used for case assets under construction that one or multiple assets will become a new asset.

· Asset Split - account_asset_management_oper_split

- When bought in a big asset, that can be decomposed it to several active asset and start depreciation.

Also notable feature mentioned by Kevin, I think should be the enhancement to the account_asset_management

· Proper handling of gain/loss on disposal

· Depreciation start date separate from asset date

@Kevin, your sharing would be great.

As for the Book and Tax, I also think it should be seperated feature. I also don't know much about it yet.

Thank you for feedback,

Kitti

On Thu, Jul 23, 2020 at 1:37 PM <luc.demeyer@noviat.com> wrote:

I think we should make two documents

- Asset impairment (a feature to be added to the base module)

- Tax depreciation (imho a separate add-on module)

The other two are small features already available in some form in the current module.

Luc

From: Jonathan Wilson <jonathan.wilson@willdooit.com>

Sent: Wednesday, 22 July 2020 23:02

To: Contributors <contributors@odoo-community.org>

Subject: Re: Operation related to Asset ManagementIf we could get a requirements & design document for the new features, including book & tax methods, I pretty sure I could get funding from a customer.

Kind regards

Jonathan Wilson

Chief Sales and Innovation Executive

WilldooIT Pty Ltd

Recent Linkedin articles:

First Australian Odoo GOLD partner

2017, 2015 & 2013 Odoo Best Partner Asia/Pacific

Creators of Odoo-Pentaho integration project

"Making growth through technology easy"

E: jonathan.wilson@willdooit.com

P: +61 3 9135 1900

M: +61 4 000 17 444

10/435 Williamstown Road

Port Melbourne VIC 3207

DISCLAIMER | This electronic message together with any attachments is confidential. If you are not the recipient, do not copy, disclose, or use the contents in any way. Please also advise us by e-mail that you have received this message in error and then please destroy this email and any of its attachments. WilldooIT Pty. Ltd. is not responsible for any changes made to this message and/or any attachments after sending by Willdoo IT Pty. Ltd. WilldooIT Pty. Ltd. use virus scanning software but exclude all liability for virus or anything similar in this email or attachment.

On Thu, 23 Jul 2020 at 05:32, Kevin McMenamin <Kevin.McMenamin@solnet.co.nz> wrote:

We have done quite a bit around assets and happy to share (currently still on V11)

- Proper handling of gain/loss on disposal

- Asset impairment

- Depreciation start date separate from asset date

- Accounting & Tax depreciation rates (we handle tax via reporting as typically done annually)

Plus have tidied up various accounting elements to ensure works correctly.

Happy to share.

Regards

Kevin McMenamin

ERP Capability Manager, Solnet

+64 22 651 3753 | +64 9 977 5805 | Visit our blog | Connect on LinkedIn

From: luc.demeyer@noviat.com <luc.demeyer@noviat.com>

Sent: Wednesday, 22 July 2020 7:27 PM

To: Contributors <contributors@odoo-community.org>

Subject: RE: Operation related to Asset ManagementI am not sure if we need to add the book & tax feature into the base module.

I think it’s more a feature for an add-on module.

Luc

From: Jonathan Wilson <jonathan.wilson@willdooit.com>

Sent: Wednesday, 22 July 2020 08:33

To: Contributors <contributors@odoo-community.org>

Subject: Re: Operation related to Asset ManagementHi Kitti

My experience with decent Asset apps is that they have that functionality. Additionally, they usually have 2 modes of depreciation - "Book" and "Tax" - if we could add those features (and the ones you mentioned) I would fee a lot more comfortable offering up Odoo as a decent asset register.

Kind regards

Jonathan Wilson

Chief Sales and Innovation Executive

WilldooIT Pty Ltd

Recent Linkedin articles:

First Australian Odoo GOLD partner

2017, 2015 & 2013 Odoo Best Partner Asia/Pacific

Creators of Odoo-Pentaho integration project

"Making growth through technology easy"

E: jonathan.wilson@willdooit.com

P: +61 3 9135 1900

M: +61 4 000 17 444

10/435 Williamstown Road

Port Melbourne VIC 3207

DISCLAIMER | This electronic message together with any attachments is confidential. If you are not the recipient, do not copy, disclose, or use the contents in any way. Please also advise us by e-mail that you have received this message in error and then please destroy this email and any of its attachments. WilldooIT Pty. Ltd. is not responsible for any changes made to this message and/or any attachments after sending by Willdoo IT Pty. Ltd. WilldooIT Pty. Ltd. use virus scanning software but exclude all liability for virus or anything similar in this email or attachment.

On Wed, 22 Jul 2020 at 16:17, Kitti Upariphutthiphong <kittiu@ecosoft.co.th> wrote:

Dear community,

My I check whether the following feature is relevant to OCA or being useful.

We done Odoo and got to learn some practice from an organization that deal with a lot of asset. Both normal asset, low valued asset, asset in transit, asset under construction.

They have asset operation like,

- Change Ownership,

- i.e, change cost center (analytic)

- Value Adjustment,

- i.e., knowing sometime later that, there are additional expenditure into that assets and so the value should be increased

- Transfer (merge or split),

- i.e., 2 asset under construction, merged as new final working Asset.

- An normal acquired asset that splits into smaller assets.

We would love to port these features into OCA. But I am not very sure it will be useful, nor is it generic enough.

Any comments?

Kitti

_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribeAttention: This email may contain information intended for the sole use of the original recipient. Please respect this when sharing or disclosing this email's contents with any third party. If you believe you have received this email in error, please delete it and notify the sender or postmaster@solnetsolutions.co.nz as soon as possible. The content of this email does not necessarily reflect the views of Solnet Solutions Ltd.

_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe

by Kevin McMenamin - 11:26 - 29 Jul 2020 -

Re: Project vs Sale Orders=> Margin

Only the Community one, that’s why I’m struggling to find the needed module

On 28 Jul 2020, at 22:52, Jonathan Wilson <jonathan.wilson@willdooit.com> wrote:If we are talking about enterprise Odoo, then that is the P&L report sliced by the analytic.Kind regardsJonathan WilsonChief Sales and Innovation ExecutiveWilldooIT Pty LtdRecent Linkedin articles:First Australian Odoo GOLD partner2017, 2015 & 2013 Odoo Best Partner Asia/PacificCreators of Odoo-Pentaho integration project"Making growth through technology easy"P: +61 3 9135 1900M: +61 4 000 17 44410/435 Williamstown RoadPort Melbourne VIC 3207DISCLAIMER | This electronic message together with any attachments is confidential. If you are not the recipient, do not copy, disclose, or use the contents in any way. Please also advise us by e-mail that you have received this message in error and then please destroy this email and any of its attachments. WilldooIT Pty. Ltd. is not responsible for any changes made to this message and/or any attachments after sending by Willdoo IT Pty. Ltd. WilldooIT Pty. Ltd. use virus scanning software but exclude all liability for virus or anything similar in this email or attachment.On Wed, 29 Jul 2020 at 01:27, Alexey Pelykh <alexey.pelykh@gmail.com> wrote:Dear community, If there’s a project that is linked to a analytic account, and multiple sale orders (through invoices) “contribute” to that analytic account, is there a module that would give Margin at analytic account or project level? Kind regards, Alexey

_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe

_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe

by Alexey Pelykh <alexey.pelykh@gmail.com> - 01:00 - 29 Jul 2020 -

Re: Project vs Sale Orders=> Margin

If we are talking about enterprise Odoo, then that is the P&L report sliced by the analytic.Kind regardsJonathan Wilson

Chief Sales and Innovation Executive

WilldooIT Pty Ltd

Recent Linkedin articles:First Australian Odoo GOLD partner2017, 2015 & 2013 Odoo Best Partner Asia/PacificCreators of Odoo-Pentaho integration project"Making growth through technology easy"

E: jonathan.wilson@willdooit.com

P: +61 3 9135 1900

M: +61 4 000 17 444

10/435 Williamstown Road

Port Melbourne VIC 3207

DISCLAIMER | This electronic message together with any attachments is confidential. If you are not the recipient, do not copy, disclose, or use the contents in any way. Please also advise us by e-mail that you have received this message in error and then please destroy this email and any of its attachments. WilldooIT Pty. Ltd. is not responsible for any changes made to this message and/or any attachments after sending by Willdoo IT Pty. Ltd. WilldooIT Pty. Ltd. use virus scanning software but exclude all liability for virus or anything similar in this email or attachment.

On Wed, 29 Jul 2020 at 01:27, Alexey Pelykh <alexey.pelykh@gmail.com> wrote:Dear community, If there’s a project that is linked to a analytic account, and multiple sale orders (through invoices) “contribute” to that analytic account, is there a module that would give Margin at analytic account or project level? Kind regards, Alexey

_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe

by Jonathan Wilson - 10:51 - 28 Jul 2020 -

Project vs Sale Orders=> Margin

Dear community, If there’s a project that is linked to a analytic account, and multiple sale orders (through invoices) “contribute” to that analytic account, is there a module that would give Margin at analytic account or project level? Kind regards, Alexey

by Alexey Pelykh <alexey.pelykh@gmail.com> - 05:25 - 28 Jul 2020 -

Re: Request for being "CRM, Sales & Marketing Maintainers" PSC representative

Yeah, thanks.Regards.

by Pedro M. Baeza - 02:16 - 28 Jul 2020 -

Re: Request for being "CRM, Sales & Marketing Maintainers" PSC representative

Hi Pedro,I added you yesterday and it looks like the sync script did its job.Best regards,-sbiOn Mon, Jul 27, 2020 at 8:26 AM Roussel, Denis <denis.roussel@acsone.eu> wrote:+1 of course!On Fri, Jul 24, 2020 at 10:21 PM Rafael Blasco <rafael.blasco@tecnativa.com> wrote:+1

De: Kitti Upariphutthiphong [mailto:kittiu@ecosoft.co.th]

Enviado el: viernes, 24 de julio de 2020 15:32

Para: Contributors <contributors@odoo-community.org>

Asunto: Re: Request for being "CRM, Sales & Marketing Maintainers" PSC representative+1 and thank you.

On Fri, 24 Jul 2020, 14:57 Pedro M. Baeza (Tecnativa), <pedro.baeza@tecnativa.com> wrote:

As stated in https://github.com/OCA/commission/issues/247#issuecomment-663392257, there's no PSC representative for it, so I'm applying for not having that hole.

You can see my whole activity in https://github.com/pedrobaeza, touching frequently OCA/CRM, OCA/commission and other related repos.

Regards.

_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe

--__________________________________________

Denis Roussel

Software Engineer

Acsone SA, Succursale de Liège (Val Benoît)

Tel : +32 2 888 31 49

Fax : +32 2 888 31 59

Gsm : +32 472 22 00 57Acsone sa/nv

Boulevard de la Woluwe 56 Woluwedal | B-1200 Brussels | BelgiumQuai Banning, 6 (Val Benoît) | B-4000 Liège | Belgium

Zone Industrielle 22 | L-8287 Kehlen | Luxembourg_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe

by Stéphane Bidoul - 02:11 - 28 Jul 2020 -

Re: Request for being "CRM, Sales & Marketing Maintainers" PSC representative

+1 of course!On Fri, Jul 24, 2020 at 10:21 PM Rafael Blasco <rafael.blasco@tecnativa.com> wrote:+1

De: Kitti Upariphutthiphong [mailto:kittiu@ecosoft.co.th]

Enviado el: viernes, 24 de julio de 2020 15:32

Para: Contributors <contributors@odoo-community.org>

Asunto: Re: Request for being "CRM, Sales & Marketing Maintainers" PSC representative+1 and thank you.

On Fri, 24 Jul 2020, 14:57 Pedro M. Baeza (Tecnativa), <pedro.baeza@tecnativa.com> wrote:

As stated in https://github.com/OCA/commission/issues/247#issuecomment-663392257, there's no PSC representative for it, so I'm applying for not having that hole.

You can see my whole activity in https://github.com/pedrobaeza, touching frequently OCA/CRM, OCA/commission and other related repos.

Regards.

_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe

--__________________________________________

Denis Roussel

Software Engineer

Acsone SA, Succursale de Liège (Val Benoît)

Tel : +32 2 888 31 49

Fax : +32 2 888 31 59

Gsm : +32 472 22 00 57Acsone sa/nv

Boulevard de la Woluwe 56 Woluwedal | B-1200 Brussels | BelgiumQuai Banning, 6 (Val Benoît) | B-4000 Liège | Belgium

Zone Industrielle 22 | L-8287 Kehlen | Luxembourg

by Denis Roussel - 08:25 - 27 Jul 2020 -

RE: Operation related to Asset Management

My coments , cf inline (>>> marks)

From: Kitti Upariphutthiphong <kittiu@ecosoft.co.th>

Sent: Saturday, 25 July 2020 06:17

To: Contributors <contributors@odoo-community.org>

Subject: Re: Operation related to Asset ManagementThank you all,

@Jonathan, I am not quite familiar with the Book and Tax. I have asked our functional consult, and we think it is also a case in our country, although it is not very common (still not sure it is the same thing as yours). Do you have more detail on what it is, somewhere I can read?

@Luc, from what I understand here, we need the same, but the naming may be a bit different (we also need the right business name). So, here is the refined list of TODO from me, please help redefine it, or suggest better terms if you are certain.

Should I call this set of feature, Asset Operations? Which I think it should be separated, WDYT?

- Asset Revaluation -- account_asset_management_oper_revalue

- Not only impairment but value increment, so I think this name is ok?

>>> The value of an asset can be re-evaluated and become higher or lower. I don’t think we need to invent a separate module name but add it as a feature into the account_asset_management module.

· Asset Merge - account_asset_management_oper_merge

- At first I used transfer for both merge and split

- Mainly used for case assets under construction that one or multiple assets will become a new asset.

· Asset Split - account_asset_management_oper_split

- When bought in a big asset, that can be decomposed it to several active asset and start depreciation.

>>> Imho also a feature to add into the account_asset_management module.

Also notable feature mentioned by Kevin, I think should be the enhancement to the account_asset_management

· Proper handling of gain/loss on disposal

· Depreciation start date separate from asset date

@Kevin, your sharing would be great.

As for the Book and Tax, I also think it should be seperated feature. I also don't know much about it yet.

Thank you for feedback,

Kitti

On Thu, Jul 23, 2020 at 1:37 PM <luc.demeyer@noviat.com> wrote:

I think we should make two documents

- Asset impairment (a feature to be added to the base module)

- Tax depreciation (imho a separate add-on module)

The other two are small features already available in some form in the current module.

Luc

From: Jonathan Wilson <jonathan.wilson@willdooit.com>

Sent: Wednesday, 22 July 2020 23:02

To: Contributors <contributors@odoo-community.org>

Subject: Re: Operation related to Asset ManagementIf we could get a requirements & design document for the new features, including book & tax methods, I pretty sure I could get funding from a customer.

Kind regards

Jonathan Wilson

Chief Sales and Innovation Executive

WilldooIT Pty Ltd

Recent Linkedin articles:

First Australian Odoo GOLD partner

2017, 2015 & 2013 Odoo Best Partner Asia/Pacific

Creators of Odoo-Pentaho integration project

"Making growth through technology easy"

E: jonathan.wilson@willdooit.com

P: +61 3 9135 1900

M: +61 4 000 17 444

10/435 Williamstown Road

Port Melbourne VIC 3207

DISCLAIMER | This electronic message together with any attachments is confidential. If you are not the recipient, do not copy, disclose, or use the contents in any way. Please also advise us by e-mail that you have received this message in error and then please destroy this email and any of its attachments. WilldooIT Pty. Ltd. is not responsible for any changes made to this message and/or any attachments after sending by Willdoo IT Pty. Ltd. WilldooIT Pty. Ltd. use virus scanning software but exclude all liability for virus or anything similar in this email or attachment.

On Thu, 23 Jul 2020 at 05:32, Kevin McMenamin <Kevin.McMenamin@solnet.co.nz> wrote:

We have done quite a bit around assets and happy to share (currently still on V11)

- Proper handling of gain/loss on disposal

- Asset impairment

- Depreciation start date separate from asset date

- Accounting & Tax depreciation rates (we handle tax via reporting as typically done annually)

Plus have tidied up various accounting elements to ensure works correctly.

Happy to share.

Regards

Kevin McMenamin

ERP Capability Manager, Solnet

+64 22 651 3753 | +64 9 977 5805 | Visit our blog | Connect on LinkedIn

From: luc.demeyer@noviat.com <luc.demeyer@noviat.com>

Sent: Wednesday, 22 July 2020 7:27 PM

To: Contributors <contributors@odoo-community.org>

Subject: RE: Operation related to Asset ManagementI am not sure if we need to add the book & tax feature into the base module.

I think it’s more a feature for an add-on module.

Luc

From: Jonathan Wilson <jonathan.wilson@willdooit.com>

Sent: Wednesday, 22 July 2020 08:33

To: Contributors <contributors@odoo-community.org>

Subject: Re: Operation related to Asset ManagementHi Kitti

My experience with decent Asset apps is that they have that functionality. Additionally, they usually have 2 modes of depreciation - "Book" and "Tax" - if we could add those features (and the ones you mentioned) I would fee a lot more comfortable offering up Odoo as a decent asset register.

Kind regards

Jonathan Wilson

Chief Sales and Innovation Executive

WilldooIT Pty Ltd

Recent Linkedin articles:

First Australian Odoo GOLD partner

2017, 2015 & 2013 Odoo Best Partner Asia/Pacific

Creators of Odoo-Pentaho integration project

"Making growth through technology easy"

E: jonathan.wilson@willdooit.com

P: +61 3 9135 1900

M: +61 4 000 17 444

10/435 Williamstown Road

Port Melbourne VIC 3207

DISCLAIMER | This electronic message together with any attachments is confidential. If you are not the recipient, do not copy, disclose, or use the contents in any way. Please also advise us by e-mail that you have received this message in error and then please destroy this email and any of its attachments. WilldooIT Pty. Ltd. is not responsible for any changes made to this message and/or any attachments after sending by Willdoo IT Pty. Ltd. WilldooIT Pty. Ltd. use virus scanning software but exclude all liability for virus or anything similar in this email or attachment.

On Wed, 22 Jul 2020 at 16:17, Kitti Upariphutthiphong <kittiu@ecosoft.co.th> wrote:

Dear community,

My I check whether the following feature is relevant to OCA or being useful.

We done Odoo and got to learn some practice from an organization that deal with a lot of asset. Both normal asset, low valued asset, asset in transit, asset under construction.

They have asset operation like,

- Change Ownership,

- i.e, change cost center (analytic)

- Value Adjustment,

- i.e., knowing sometime later that, there are additional expenditure into that assets and so the value should be increased

- Transfer (merge or split),

- i.e., 2 asset under construction, merged as new final working Asset.

- An normal acquired asset that splits into smaller assets.

We would love to port these features into OCA. But I am not very sure it will be useful, nor is it generic enough.

Any comments?

Kitti

_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribeAttention: This email may contain information intended for the sole use of the original recipient. Please respect this when sharing or disclosing this email's contents with any third party. If you believe you have received this email in error, please delete it and notify the sender or postmaster@solnetsolutions.co.nz as soon as possible. The content of this email does not necessarily reflect the views of Solnet Solutions Ltd.

_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe

by Luc De Meyer. - 05:50 - 25 Jul 2020 -

Re: Operation related to Asset Management

@kitti We sometimes call "Directors" and tax depreciation. Here is not a bad description. Basically they are different deprecation methods/formulas for the same item - one for the company's GL and the other for the tax department. The directors may value the assets differently from what is reported in the company's tax returns. The "Book" depreciation is the one that is recorded in the GL. No problems if this is a separate module. Conceptually I think it would be fairly straight forward to extend the base Asset model (not being a programmer!).The other features would certainly be welcome.Like I said I may be able to get some funding if that makes things easier?Kind regardsJonathan Wilson

Chief Sales and Innovation Executive

WilldooIT Pty Ltd

Recent Linkedin articles:First Australian Odoo GOLD partner2017, 2015 & 2013 Odoo Best Partner Asia/PacificCreators of Odoo-Pentaho integration project"Making growth through technology easy"

E: jonathan.wilson@willdooit.com

P: +61 3 9135 1900

M: +61 4 000 17 444

10/435 Williamstown Road

Port Melbourne VIC 3207

DISCLAIMER | This electronic message together with any attachments is confidential. If you are not the recipient, do not copy, disclose, or use the contents in any way. Please also advise us by e-mail that you have received this message in error and then please destroy this email and any of its attachments. WilldooIT Pty. Ltd. is not responsible for any changes made to this message and/or any attachments after sending by Willdoo IT Pty. Ltd. WilldooIT Pty. Ltd. use virus scanning software but exclude all liability for virus or anything similar in this email or attachment.

On Sat, 25 Jul 2020 at 14:17, Kitti Upariphutthiphong <kittiu@ecosoft.co.th> wrote:Thank you all,@Jonathan, I am not quite familiar with the Book and Tax. I have asked our functional consult, and we think it is also a case in our country, although it is not very common (still not sure it is the same thing as yours). Do you have more detail on what it is, somewhere I can read?@Luc, from what I understand here, we need the same, but the naming may be a bit different (we also need the right business name). So, here is the refined list of TODO from me, please help redefine it, or suggest better terms if you are certain.Should I call this set of feature, Asset Operations? Which I think it should be separated, WDYT?- Asset Revaluation -- account_asset_management_oper_revalue

- Not only impairment but value increment, so I think this name is ok?

- Asset Merge - account_asset_management_oper_merge

- At first I used transfer for both merge and split

- Mainly used for case assets under construction that one or multiple assets will become a new asset.

- Asset Split - account_asset_management_oper_split

- When bought in a big asset, that can be decomposed it to several active asset and start depreciation.

Also notable feature mentioned by Kevin, I think should be the enhancement to the account_asset_management- Proper handling of gain/loss on disposal

- Depreciation start date separate from asset date

@Kevin, your sharing would be great.As for the Book and Tax, I also think it should be seperated feature. I also don't know much about it yet.Thank you for feedback,KittiOn Thu, Jul 23, 2020 at 1:37 PM <luc.demeyer@noviat.com> wrote:I think we should make two documents

- Asset impairment (a feature to be added to the base module)

- Tax depreciation (imho a separate add-on module)

The other two are small features already available in some form in the current module.

Luc

From: Jonathan Wilson <jonathan.wilson@willdooit.com>

Sent: Wednesday, 22 July 2020 23:02

To: Contributors <contributors@odoo-community.org>

Subject: Re: Operation related to Asset ManagementIf we could get a requirements & design document for the new features, including book & tax methods, I pretty sure I could get funding from a customer.

Kind regards

Jonathan Wilson

Chief Sales and Innovation Executive

WilldooIT Pty Ltd

Recent Linkedin articles:

First Australian Odoo GOLD partner

2017, 2015 & 2013 Odoo Best Partner Asia/Pacific

Creators of Odoo-Pentaho integration project

"Making growth through technology easy"

E: jonathan.wilson@willdooit.com

P: +61 3 9135 1900

M: +61 4 000 17 444

10/435 Williamstown Road

Port Melbourne VIC 3207

DISCLAIMER | This electronic message together with any attachments is confidential. If you are not the recipient, do not copy, disclose, or use the contents in any way. Please also advise us by e-mail that you have received this message in error and then please destroy this email and any of its attachments. WilldooIT Pty. Ltd. is not responsible for any changes made to this message and/or any attachments after sending by Willdoo IT Pty. Ltd. WilldooIT Pty. Ltd. use virus scanning software but exclude all liability for virus or anything similar in this email or attachment.

On Thu, 23 Jul 2020 at 05:32, Kevin McMenamin <Kevin.McMenamin@solnet.co.nz> wrote:

We have done quite a bit around assets and happy to share (currently still on V11)

- Proper handling of gain/loss on disposal

- Asset impairment

- Depreciation start date separate from asset date

- Accounting & Tax depreciation rates (we handle tax via reporting as typically done annually)

Plus have tidied up various accounting elements to ensure works correctly.

Happy to share.

Regards

Kevin McMenamin

ERP Capability Manager, Solnet

+64 22 651 3753 | +64 9 977 5805 | Visit our blog | Connect on LinkedIn

From: luc.demeyer@noviat.com <luc.demeyer@noviat.com>

Sent: Wednesday, 22 July 2020 7:27 PM

To: Contributors <contributors@odoo-community.org>

Subject: RE: Operation related to Asset ManagementI am not sure if we need to add the book & tax feature into the base module.

I think it’s more a feature for an add-on module.

Luc

From: Jonathan Wilson <jonathan.wilson@willdooit.com>

Sent: Wednesday, 22 July 2020 08:33

To: Contributors <contributors@odoo-community.org>

Subject: Re: Operation related to Asset ManagementHi Kitti

My experience with decent Asset apps is that they have that functionality. Additionally, they usually have 2 modes of depreciation - "Book" and "Tax" - if we could add those features (and the ones you mentioned) I would fee a lot more comfortable offering up Odoo as a decent asset register.

Kind regards

Jonathan Wilson

Chief Sales and Innovation Executive

WilldooIT Pty Ltd

Recent Linkedin articles:

First Australian Odoo GOLD partner

2017, 2015 & 2013 Odoo Best Partner Asia/Pacific

Creators of Odoo-Pentaho integration project

"Making growth through technology easy"

E: jonathan.wilson@willdooit.com

P: +61 3 9135 1900

M: +61 4 000 17 444

10/435 Williamstown Road

Port Melbourne VIC 3207

DISCLAIMER | This electronic message together with any attachments is confidential. If you are not the recipient, do not copy, disclose, or use the contents in any way. Please also advise us by e-mail that you have received this message in error and then please destroy this email and any of its attachments. WilldooIT Pty. Ltd. is not responsible for any changes made to this message and/or any attachments after sending by Willdoo IT Pty. Ltd. WilldooIT Pty. Ltd. use virus scanning software but exclude all liability for virus or anything similar in this email or attachment.

On Wed, 22 Jul 2020 at 16:17, Kitti Upariphutthiphong <kittiu@ecosoft.co.th> wrote:

Dear community,

My I check whether the following feature is relevant to OCA or being useful.

We done Odoo and got to learn some practice from an organization that deal with a lot of asset. Both normal asset, low valued asset, asset in transit, asset under construction.

They have asset operation like,

- Change Ownership,

- i.e, change cost center (analytic)

- Value Adjustment,

- i.e., knowing sometime later that, there are additional expenditure into that assets and so the value should be increased

- Transfer (merge or split),

- i.e., 2 asset under construction, merged as new final working Asset.

- An normal acquired asset that splits into smaller assets.

We would love to port these features into OCA. But I am not very sure it will be useful, nor is it generic enough.

Any comments?

Kitti

_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribeAttention: This email may contain information intended for the sole use of the original recipient. Please respect this when sharing or disclosing this email's contents with any third party. If you believe you have received this email in error, please delete it and notify the sender or postmaster@solnetsolutions.co.nz as soon as possible. The content of this email does not necessarily reflect the views of Solnet Solutions Ltd.

_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe

_______________________________________________

Mailing-List: https://odoo-community.org/groups/contributors-15

Post to: mailto:contributors@odoo-community.org

Unsubscribe: https://odoo-community.org/groups?unsubscribe

by Jonathan Wilson - 07:01 - 25 Jul 2020 -

Re: Operation related to Asset Management